IQ Option is a highly popular trading platform with a presence in over thirty countries. It boasts 7 million registered users, though not all of them may be active traders; many might have registered just to explore their demo account.

It’s regulated by CySEC in Cyprus and is also registered with other governmental organizations, including the British FCA, CNMV in Spain, the Italian Consob, and Regafi in France.

Hi there! I want to let you know that I have thoroughly tested IQ Option using my personal account to create this IQ Option review. Also, I hold the EFPA (European Financial Advisor #37363) certification. I’m eager to impart my expertise, insights, and comprehensive research regarding this reputable trading platform.

Josep GarciaFinancial Advisor

Naturally, before deciding to start trading with IQ Option, you’ll likely have many questions about their commissions, functionality, and the range of assets available for trading. Let me share all my findings in this IQ Review.

IQ Option Review Verdict

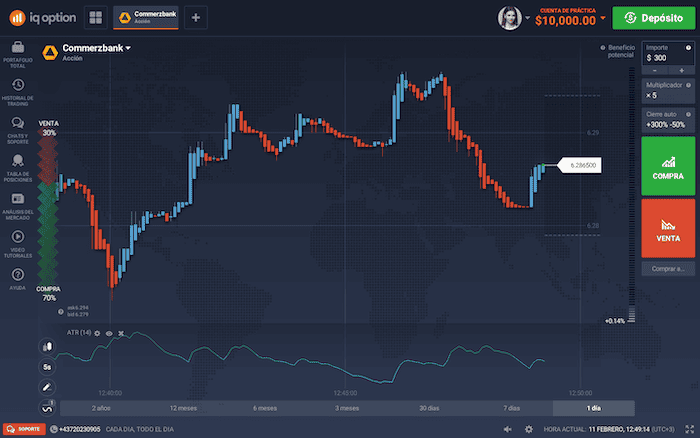

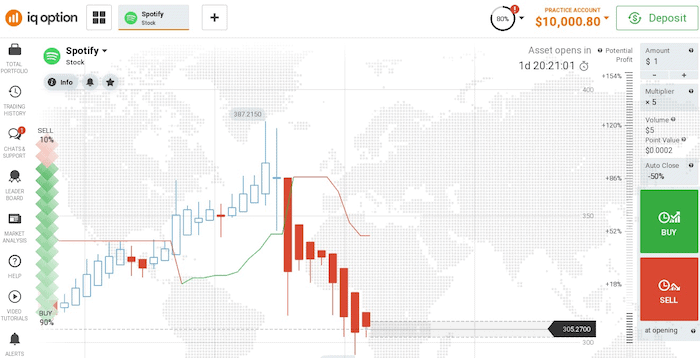

IQ Option enables trading with derivative products (CFDs) and offers over 250+ different assets, including stocks, ETFs, commodities, crypto, and forex – a selection that may not seem extensive. For finance professionals, the platform also facilitates options trading. It features a well-designed, modern interface, and the spreads are reasonable. Their platform is well-designed and looks modern, and the spreads are reasonable.

If you’re a novice trader, IQ Option might not be ideal as it requires operating with leverage and doesn’t allow purchasing real assets (like stocks or ETFs) – only derivative products are available. Alternatives such as Trading 212, XTB, or eToro could be more suitable.

Clearly, IQ Option is best suited for those focused on derivatives trading. A notable feature is the ability for financially savvy individuals to trade both options and CFDs. However, platforms like Plus500, XTB, and eToro provide a broader range of options.

IQ Option Pros & Cons

Pros

Well-Designed

The IQ Option platform, modern and user-friendly, offers practical graph analysis, though somewhat limited. More details follow.

Spreads

Generally, IQ Option’s spreads seem reasonable compared to competitors, though hard to judge.

Fast support

IQ Option’s support was always prompt when contacted. Support in languages other than English may be slower.

Regulation

IQ Option is based in Cyprus, and thus is subject to European financial regulation. Additionally, IQ Option is registered with European entities like Spain’s CNMV, France’s Regafi, and Italy’s Consob. It is also registered with the British FCA.

Trade Options

With a professional account, you can operate with options, a feature not commonly allowed by other brokers.

Cons

Slow web app

In my experience, their web app, although well-designed, is a bit slow. If you install the app in your computer it should be faster.

Few assets

Unfortunately, IQ Option does not offer the widest variety of assets for you to trade with. At the moment this review was written, it only has a total of 260 in stock, ETFs, Forex, commodities and cryptocurrency CFDs. There are other brokers that offer more variety.

Inactivity fee

If you don’t use IQ Option for three months you will be charged a monthly inactivity fee of $10.

IQ Option in Detail

Is IQ Option Safe?

IQ Option employs SSL connections to encrypt data exchanges with browsers and apps. It also supports secure payment systems like PayPal and Skrill.

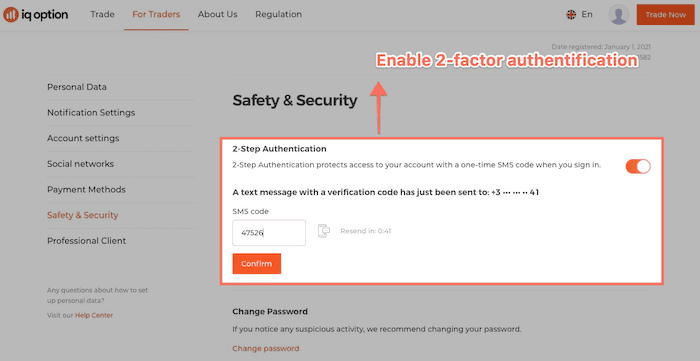

Additionally, IQ Option offers 2-step authentication for enhanced security, requiring phone confirmation for broker access.

The platform enables monitoring of open sessions and history, helping identify unauthorized access to your IQ Option account.

IQ Option Fees & Commissions

Like many trading platforms, IQ Option charges no fees for account opening, depositing, or withdrawing funds, except for bank transfers.

IQ Option imposes a monthly inactivity fee of $10 if you’re inactive for 90 days.

The platform also charges a financing fee of 0.01% to 0.6% for holding leveraged positions after market close, which may reach up to 1.7% in unspecified cases.

IQ Option applies a spread on opening or closing positions, the margin between the buying and selling prices of securities, financing market makers.

IQ Option Spread Examples

| Assets | Spread |

|---|---|

| Amazon stock CFDs | 0.09% |

| Apple stock CFDs | 0.1% |

| Coca-Cola stock CFDs | 0.212% |

| EURUSD CFDs | 0.026% |

| EURJPY CFDs | 0.083% |

| EURGBP CFDs | 0.104% |

| Bitcoin CFDs | 0.3% |

| Etherum CFDs | 2.037% |

| Litecoin CFDs | 1.528% |

| Gold CFDs | 0.072% |

| Silver CFDs | 0.168% |

| MSCI Emerging CFDs | 0.067% |

| S&P 500 CFDs | 0.023% |

Note: Keep in mind that these spreads were the ones established by IQ Option on 8th January 2021, and shall vary across time.

Assets You Can Trade with IQ Option

With IQ Option, your investment options are limited to derivative products. These derivatives don’t represent the real asset; instead, their value mirrors the price movements of the underlying assets. For example, while you can’t directly invest in Apple stocks, you can invest in a CFD based on Apple’s stock price.

Unless you are a professional (IQ Option) client with extensive financial knowledge, the only security you can use to invest will be Contracts for Difference (CFDs). Professional clients will have access to trading options on FOREX.

IQ Option offers investment opportunities in the following CFDs:

- Stock CFDs: You have nearly 180 different stock CFDs to invest in. Some of these are: Tesla, Baidu, Apple, Amazon or Spotify. Leverage is 1:5.

- ETF CFDs: With IQ Option it’s also possible to trade ETF CFDs. They have 23 different ones; this doesn’t seem like a lot, right? Leverage is the same as in stock CFDs.

- Forex CFDs: IQ Option offers 25 currency pairs to invest in through CFDs. Some of these are EUR/USD, AUD/USD, GBP/USD or GBP/JPY. Leverage is 1:30.

- Commodities CFDs: IQ Option has 4 commodities CFDs in its portfolio: gold, crude oil, silver and Brent barrel. These CFDs operate at a 1:20 leverage.

- Cryptocurrency CFDs: IQ Option offers CFDs for cryptos such as Bitcoin, Etherum, Ripple or Litecoin, a total of 12. Leverage for cryptocoin CFDs is 1:2.

Note: Please keep in mind that the aforementioned leverage levels are for retail accounts of European users. Other types of accounts may have a different leverage.

Some traders might find the absence of index CFDs notable, as they are commonly available on other platforms like Plus500, eToro, or XTB.

While IQ Option does provide a variety of products, it’s important to note that other trading platforms, such as Plus500 or XTB, offer a much larger selection, with over 2,000 different assets in their portfolios.

How Does IQ Option Work?

IQ Option provides user-friendly Android and iOS apps for trading. Users can also trade via any modern web browser. Note: The app may be somewhat slow.

To address this, IQ Option offers a faster, installable app for Windows and MAC, outperforming the browser version. External trading platforms like Metatrader 4 or 5 are incompatible with IQ Option; users must use IQ Option’s platform.

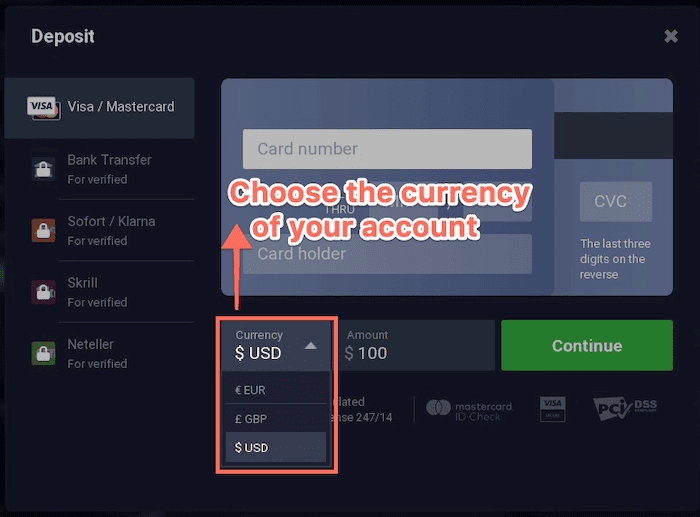

Upon first deposit, choose a currency (USD, Euros, GBP) for your IQ Option account. This choice is permanent and cannot be changed later.

Opening an Account with IQ Option

IQ Option offers a fast way to open an account. You will be able to use your own e-mail and password, or link it to your Google or Facebook account; this last option is good if you don’t want to remember passwords.

This will give you immediate access to a demo account with a virtual balance of $10,000, so you can practice and see how this trading platform works before you start with real investments.

To open an account with IQ Option, take the following steps:

- Go to www.iqoption.com and click on “Register”

- Confirm your e-mail account via the e-mail they will send you

- Add your personal details (full name, phone number, etc.)

- Confirm your telephone number (you will receive an SMS with a code)

- Upload a proof of identity (such as your passport)

- Send the required documents

- Fill in the form on our trading experience

Types of IQ Option Accounts

With IQ Option it’s possible to have three different types of account, let me tell you about their differences below:

Demo account

As I already mentioned, a couple of times, IQ Option allows users to register and use an account with virtual money (you don’t add funds) to get an idea of how the platform works, and what assets are available. This is certainly of great help when deciding whether IQ Option is for you or not.

Real account

This is the real version of the demo account. With it, you can make real investments (risking your money), and trade assets (CFDs). To access this account, you will have to verify your identity.

Keep in mind that opening a real account doesn’t mean your demo account disappears. You will still have access to both. Be careful not to trade thinking that you are on the demo account whilst actually being on the real account.

Professional account

If you are a finance professional, or you can prove that you have a certain experience trading with derivative products, IQ Option may allow you to change to a professional profile. The basic difference is that with this account you’ll be able to trade options and have even higher leverage limits.

How Does IQ Option Manage Taxes?

IQ Option will not withhold taxes on the profits you earn from their platform. As a result, you will need to personally oversee and fulfill tax obligations related to your investments.

However, the IQ Option trading platform provides a detailed overview of your transactions and earnings, along with their respective dates. This documentation can be utilized for your tax-related procedures.

It’s important to consider that, depending on your country of residence, you may be required to complete specific forms when holding funds or investments with brokers located outside your country.

Please note that the tax information provided is for general guidance only. I’m not a qualified tax advisor; this is based on personal experience and should be viewed as informational. For specific tax advice, consult a professional accountant or tax expert.

Alternatives to IQ Option

If you find some of the disadvantages mentioned earlier to be deal-breakers, you might want to explore these three alternatives to IQ Option:

Trading 212

Trading 212 is a strong alternative to IQ Option. It stands out as one of the most popular brokerage platforms in Europe, offering investment opportunities in stocks and ETFs—assets that IQ Option does not provide. Trading 212 is known for its user-friendly platform, extensive asset selection, no transaction fee charged for trading ETFs and stocks.

XTB

XTB is a versatile alternative to IQ Option. It distinguishes itself by offering the flexibility to invest in both real assets and derivatives. You can purchase stocks or ETFs on XTB, much like DEGIRO, while also having the option to engage in CFD trading, a feature commonly associated with IQ Option. Additionally, XTB boasts a more extensive asset portfolio, broadening your investment horizons.

Visit SiteeToro

eToro is a widely acclaimed alternative to IQ Option, with a vast user base. This platform allows you to invest in real assets like stocks and ETFs (only fractional). What makes eToro stand out is its innovative feature that allows you to replicate the investment strategies of other successful investors. Furthermore, eToro offers the option to engage in CFD trading without leverage. Another significant advantage is its support for the buying and selling of real cryptocurrencies, a feature that many other brokers do not provide.

Visit SiteIQ Option Review: Parting Thoughts

After our detailed examination of IQ Option, let’s recap some vital aspects:

IQ Option boasts a user-friendly, modern interface, along with reliable Android and iOS (iPhone) apps. Account setup is effortless and can be completed entirely online. In my experience, their customer support was fast and friendly.

However, it’s important to note that IQ Option exclusively offers trading in derivatives, specifically CFDs and options. Some users may find the web platform’s speed somewhat lacking. The primary drawback, however, is the relatively limited range of assets compared to their competitors.

At this point, you should have a clearer understanding of whether IQ Option aligns with your preferences. If you have any remaining questions or concerns about this platform, please feel free to leave a comment, and I’ll be happy to assist you.

83% of small investors incur losses when investing in CFDs with IQ Option. CFDs are complex high-risk products due to the leverage. You risk losing your investment.

IQ Option FAQ

IQ Option is a trading platform boasting approximately 7 million users. It distinguishes itself as an exclusive CFD broker, primarily specializing in the trading of Contracts for Difference (CFDs) for stocks, commodities, Forex, and cryptocurrencies. It’s important to note that when you trade on IQ Option, you’re engaging in derivatives trading, not direct asset ownership. In comparison to competitors like eToro or XTB, IQ Option falls short in terms of the diversity of investment assets it offers. Furthermore, some users have reported that the platform’s performance can be somewhat sluggish when accessed through a web browser on a computer.

IQ Option is registered in Cyprus under the registration number 905 LLC 2021. To be completely transparent, it’s worth noting that there is limited publicly available information regarding the company, its physical offices, and regulatory details. A more comprehensive disclosure on these aspects would be greatly appreciated.

Dmitry Zaretsky serves as the primary founder and owner of the company. However, due to its status as a non-publicly traded entity, gaining insight into the company’s ownership structure can be challenging. It’s regrettable that their website does not provide substantial information about their team and leadership.

IQ Option is unquestionably a reputable online trading platform, established in 2013, offering a diverse selection of tradable assets encompassing binary options, stocks, forex, and cryptocurrencies. It enjoys global popularity, boasting a substantial user base spanning various continents. The platform operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC) within the European Economic Area and holds licenses in other jurisdictions as well. This robust regulatory framework stands as a crucial assurance of the platform’s legitimacy and the security it provides to traders.

Add a new review

Your email address will not be published.